Skip hours of research, get investment insights in seconds

Skip hours of research, get investment insights in seconds

Our AI reads and analyzes thousands of financial sources daily, then delivers personalized insights for your investments. You do nothing - we do the work.

Our AI reads and analyzes thousands of financial sources daily, then delivers personalized insights for your investments. You do nothing - we do the work.

4.9 on review

From 2000+ subscriptions

2 minutes to set up,

7+ hours saved weekly

2 minutes to set up,

7+ hours saved weekly

01

Quick preferences setup

Quick preferences setup

Tell us what investments interest you (2 minutes)

Tell us what investments interest you (2 minutes)

02

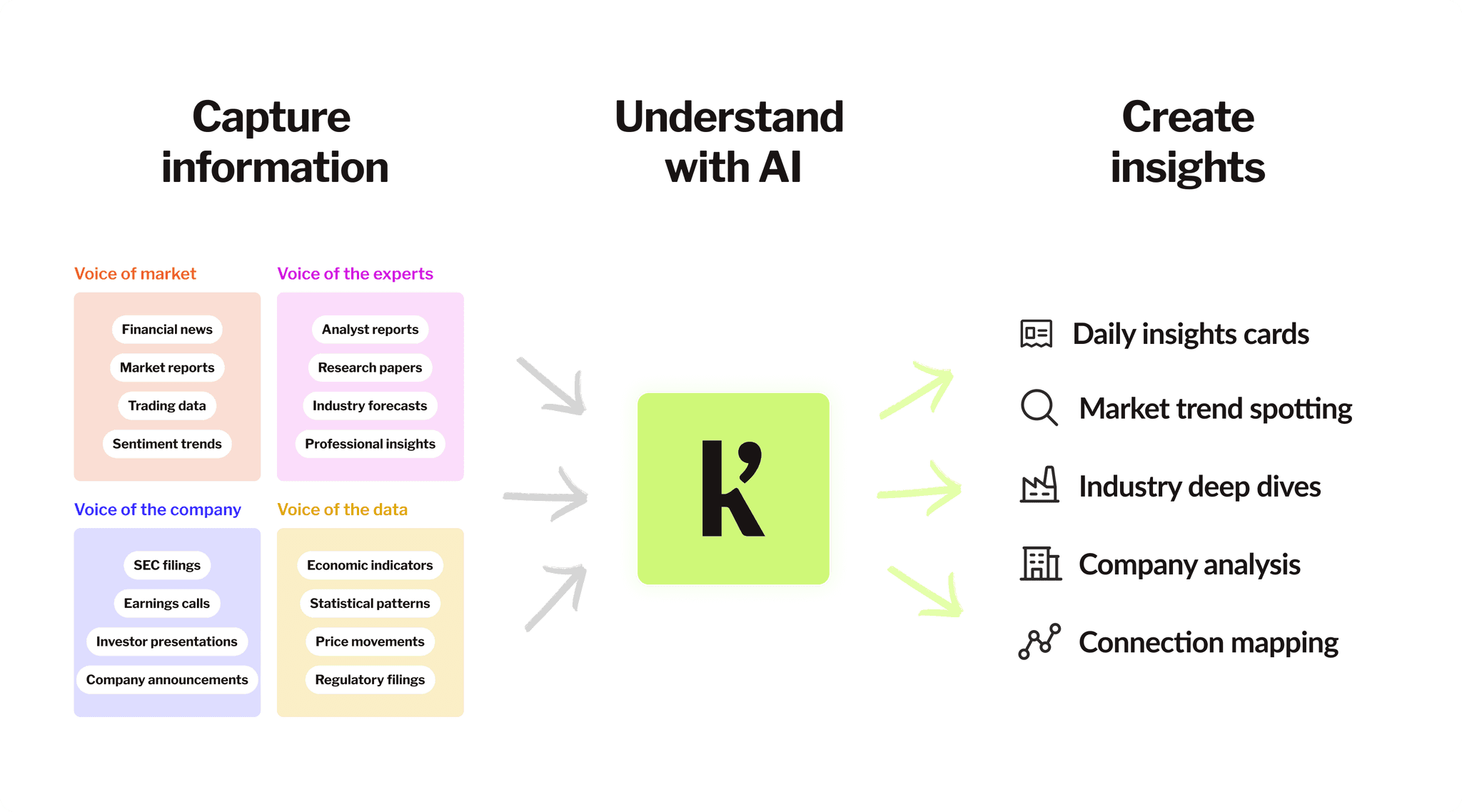

AI analyzes thousands of data

AI analyzes thousands of data

Our technology connects dots across news, reports, and data that most investors miss completely.

Our technology connects dots across news, reports, and data that most investors miss completely.

03

Daily insights

Daily insights

Get insight cards, without doing any research.

The Problem

Drowning in financial data and news? You're not alone.

Every day, you're bombarded with market news, reports, and indicators. Hours of research leave you overwhelmed. You've only half-understood the crucial details, leaving you unable to spot trends or anticipate market shifts…

Meanwhile, Wall Street pros stay one step ahead. Opportunities are out there, but you can't spot them!

The Problem

Drowning in financial data and news? You're not alone.

Every day, you're bombarded with market news, reports, and indicators. Hours of research leave you overwhelmed. You've only half-understood the crucial details, leaving you unable to spot trends or anticipate market shifts…

Meanwhile, Wall Street pros stay one step ahead. Opportunities are out there, but you can't spot them!

The Problem

Drowning in financial data and news? You're not alone.

Every day, you're bombarded with market news, reports, and indicators. Hours of research leave you overwhelmed. You've only half-understood the crucial details, leaving you unable to spot trends or anticipate market shifts…

Meanwhile, Wall Street pros stay one step ahead. Opportunities are out there, but you can't spot them!

The Solution

The Solution

The Solution

Now, there's a better way with knowhy

Now, there's a better way with knowhy

Get daily insights and deep research at your fingertips

Get daily insights and deep research at your fingertips

No worries,

No worries,

We're not another general AI tool, not another news feed aggregator…

We're not another general AI tool, not another news feed aggregator…

knowhy

knowhy

You receive insights without doing the work

Personalized insights delivered automatically

Minutes daily

One setup, then just review and decide

General AI tools

(ChatGPT, etc)

You do all the research work

Must know what to ask in the chatbot

Hours spent crafting and refining prompts

You have to connect the dots yourself

Financial news sites

(Yahoo Finance, etc)

Information overload. No insight

Overwhelmed with generic information

Endless scrolling and filtering

No explanation of why news matters to your investments

The difference? You save 7+ hours weekly while catching opportunities others miss.

The difference? You save 7+ hours weekly while catching opportunities others miss.

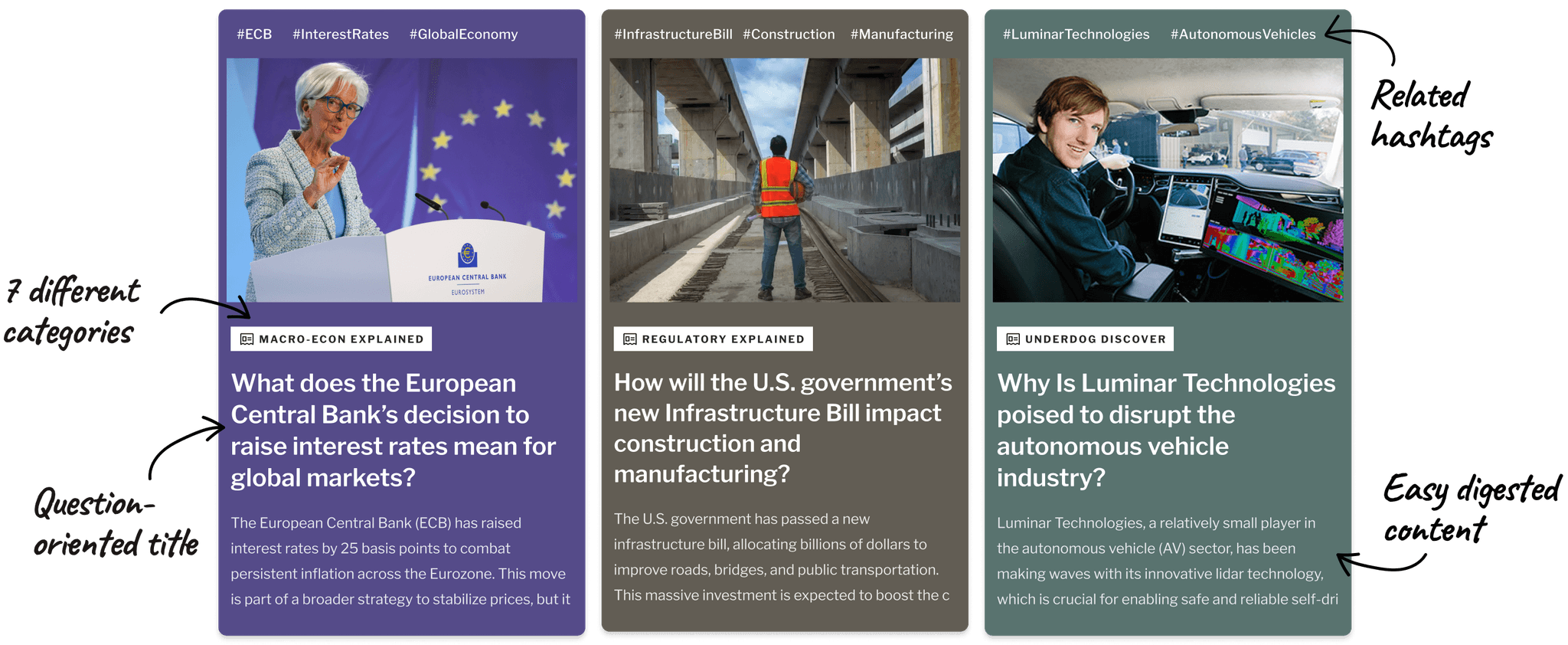

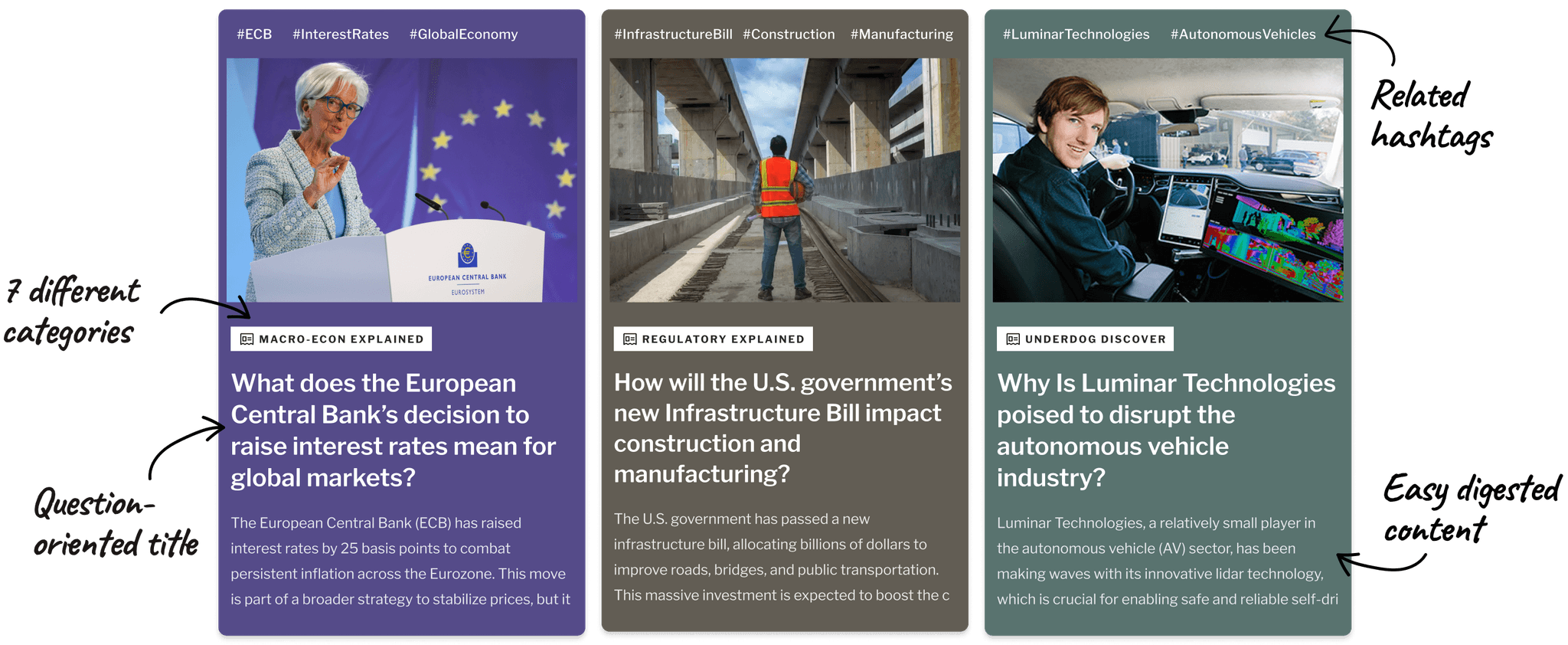

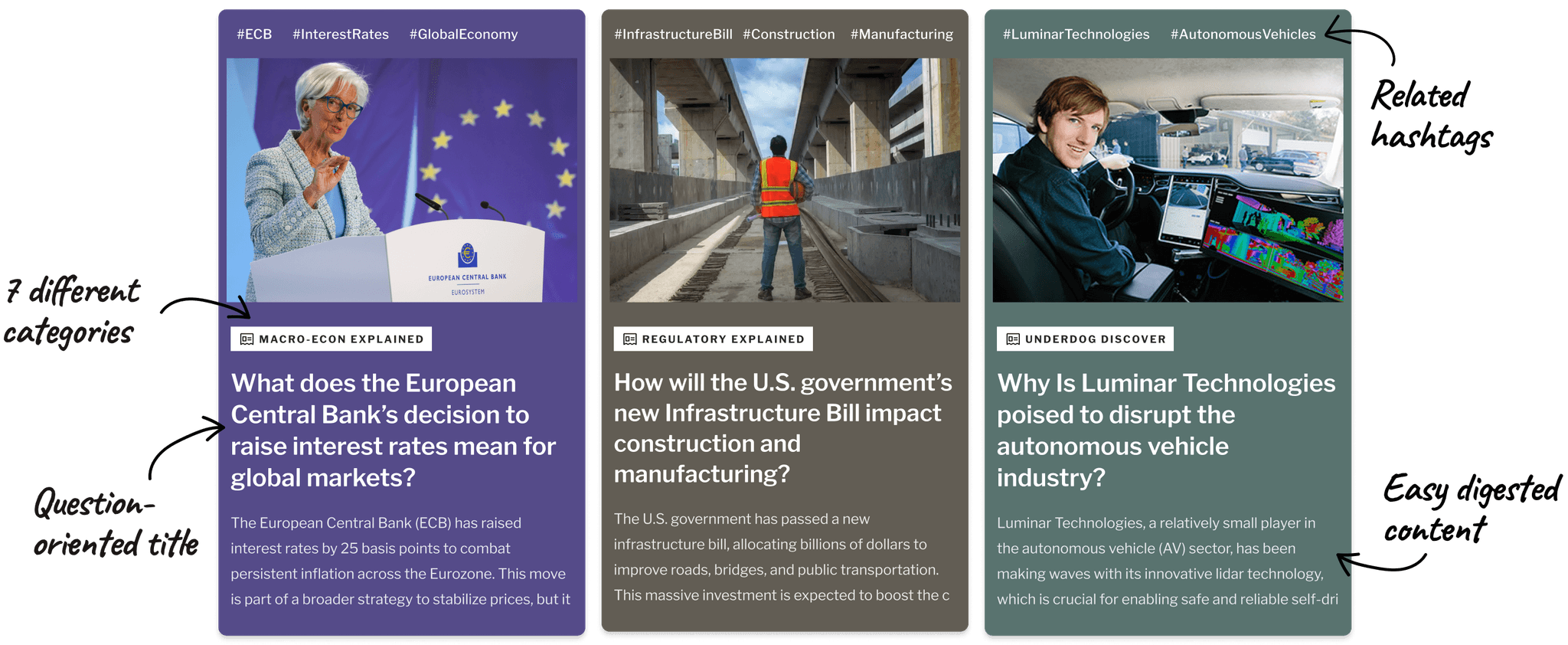

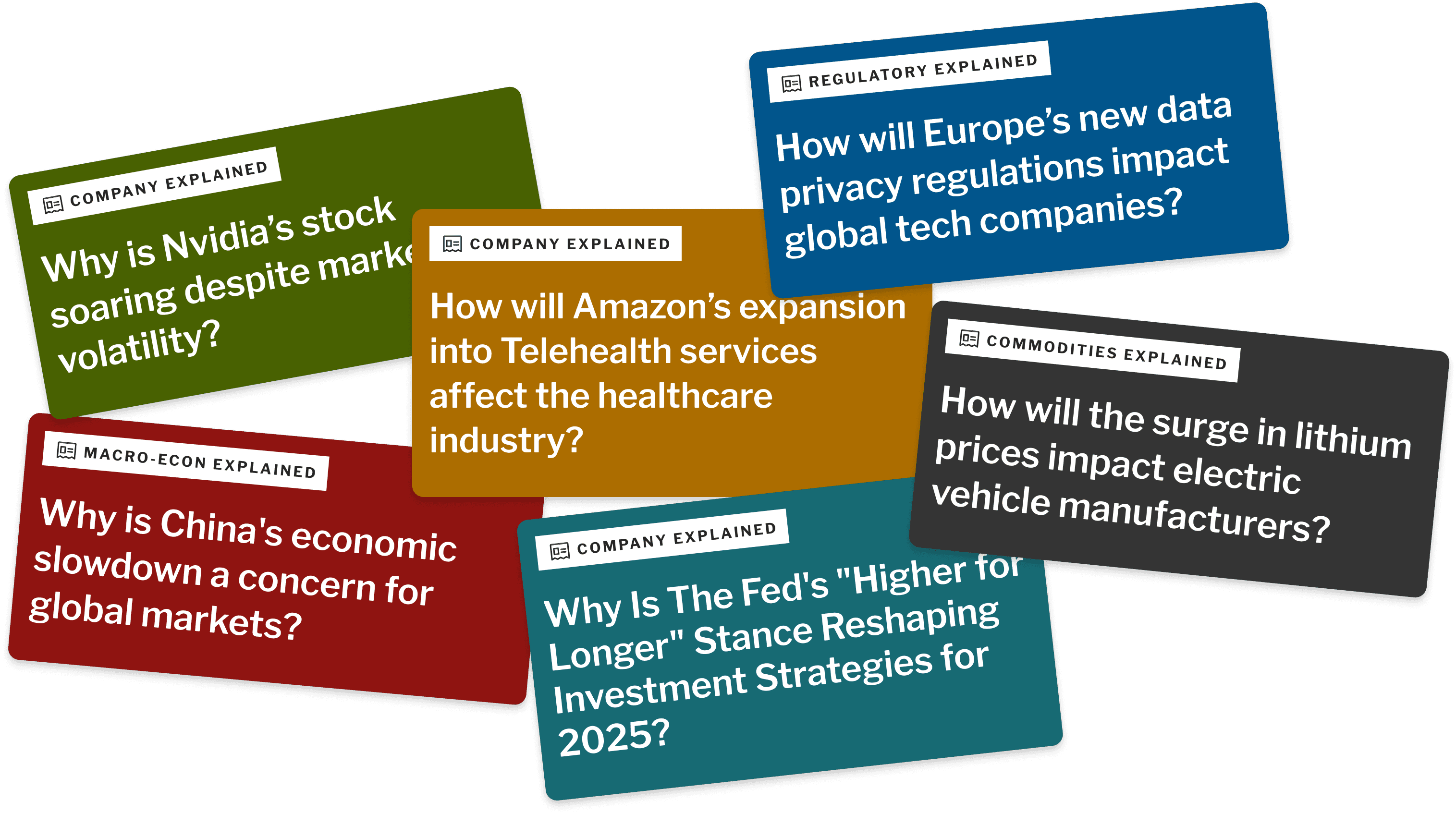

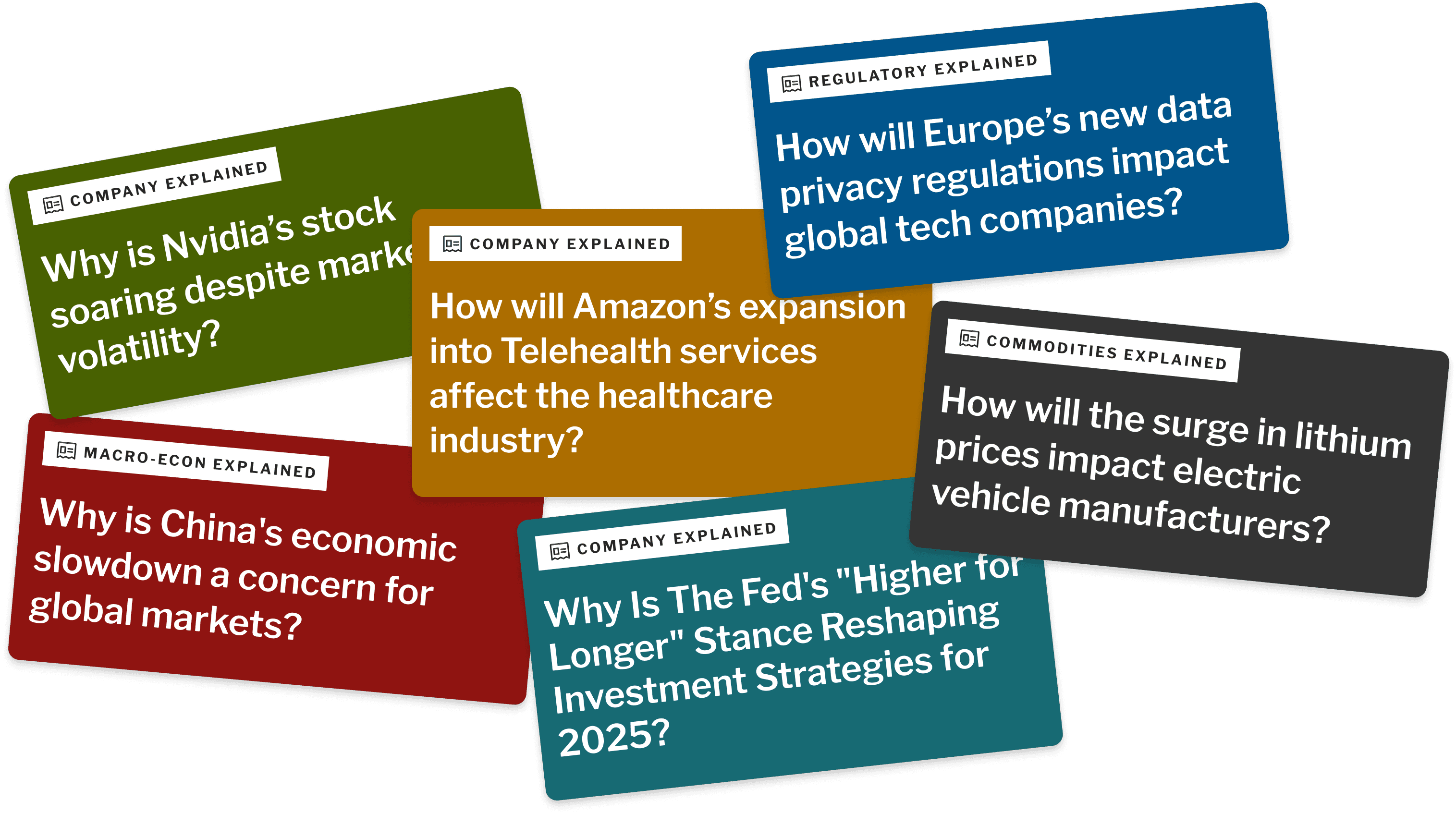

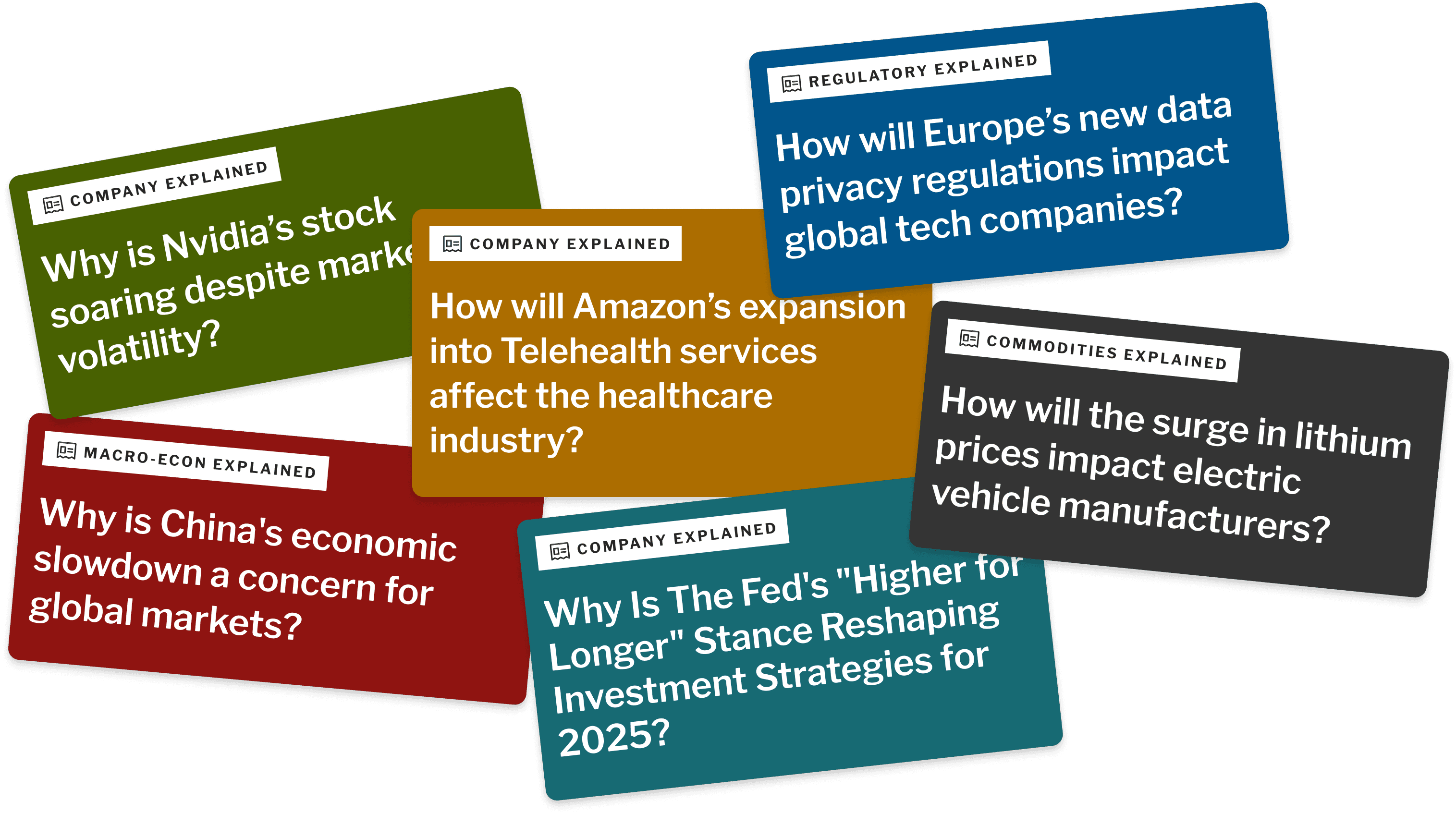

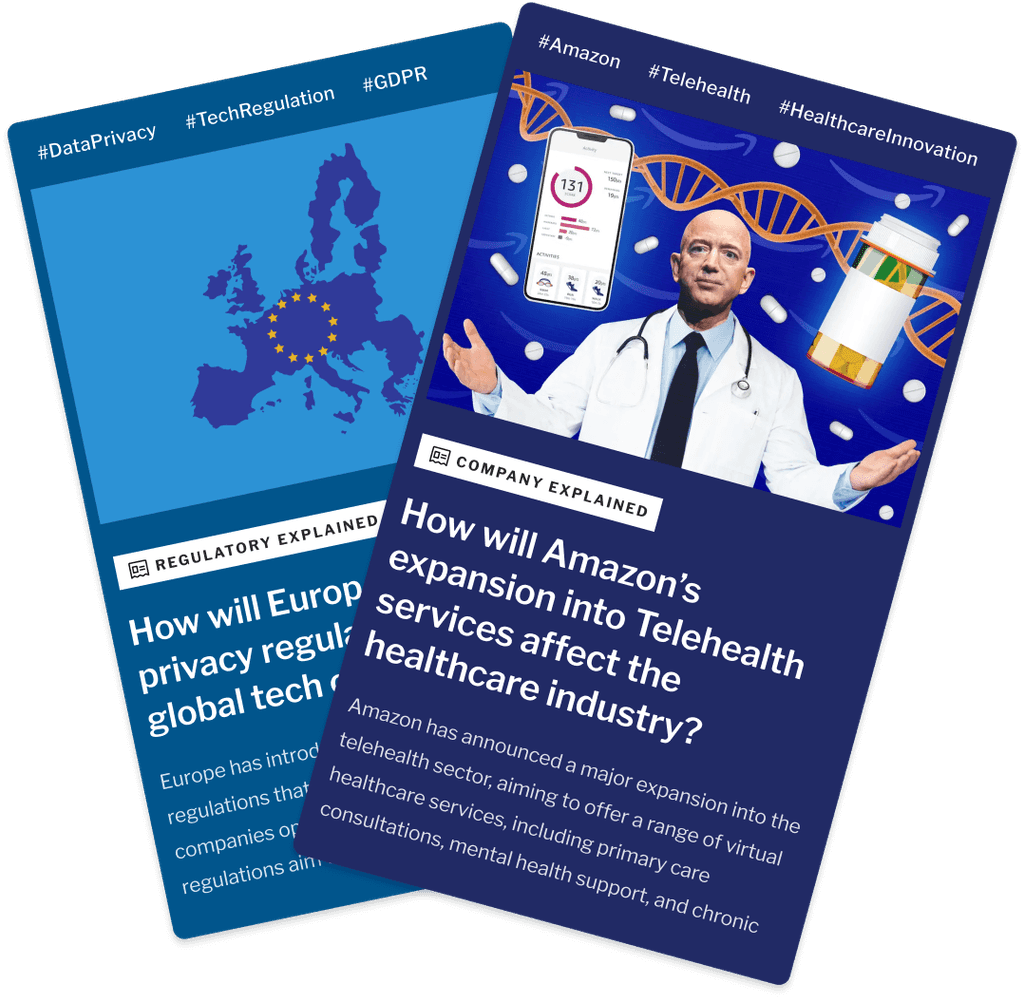

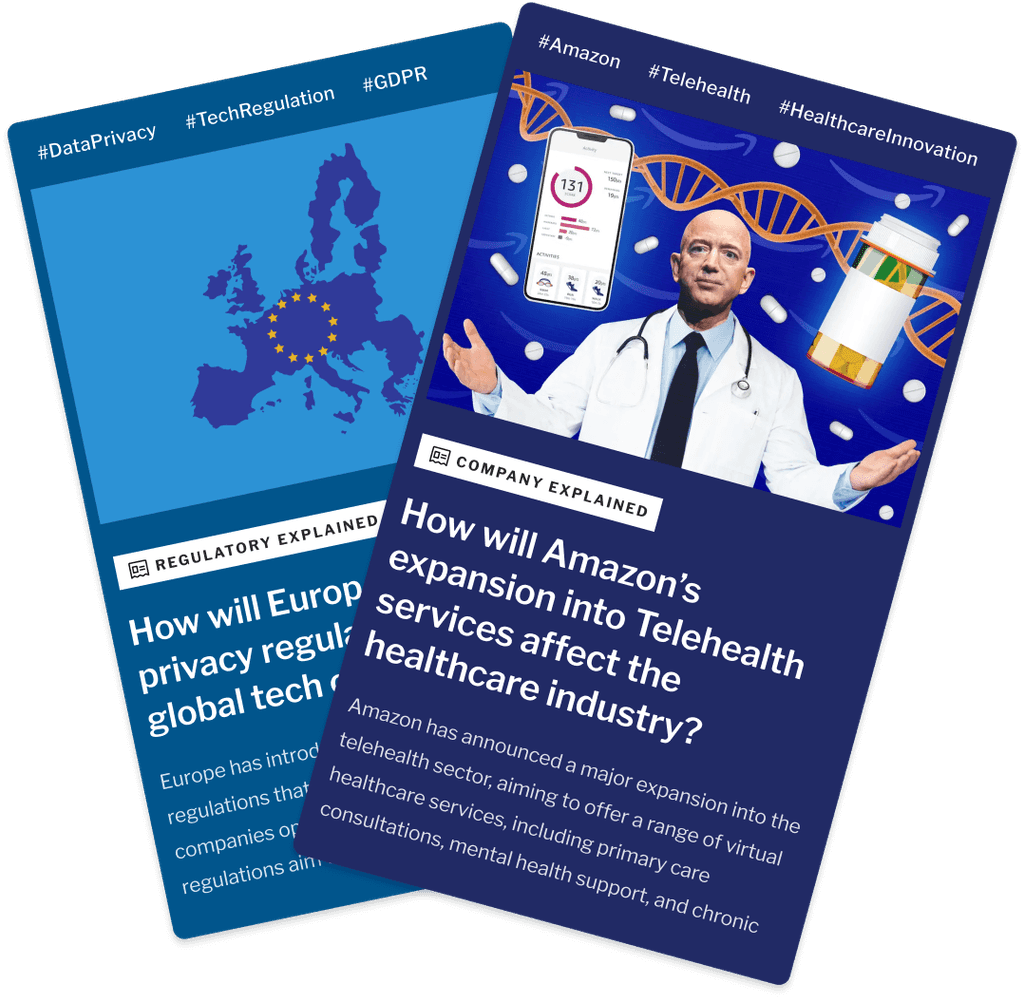

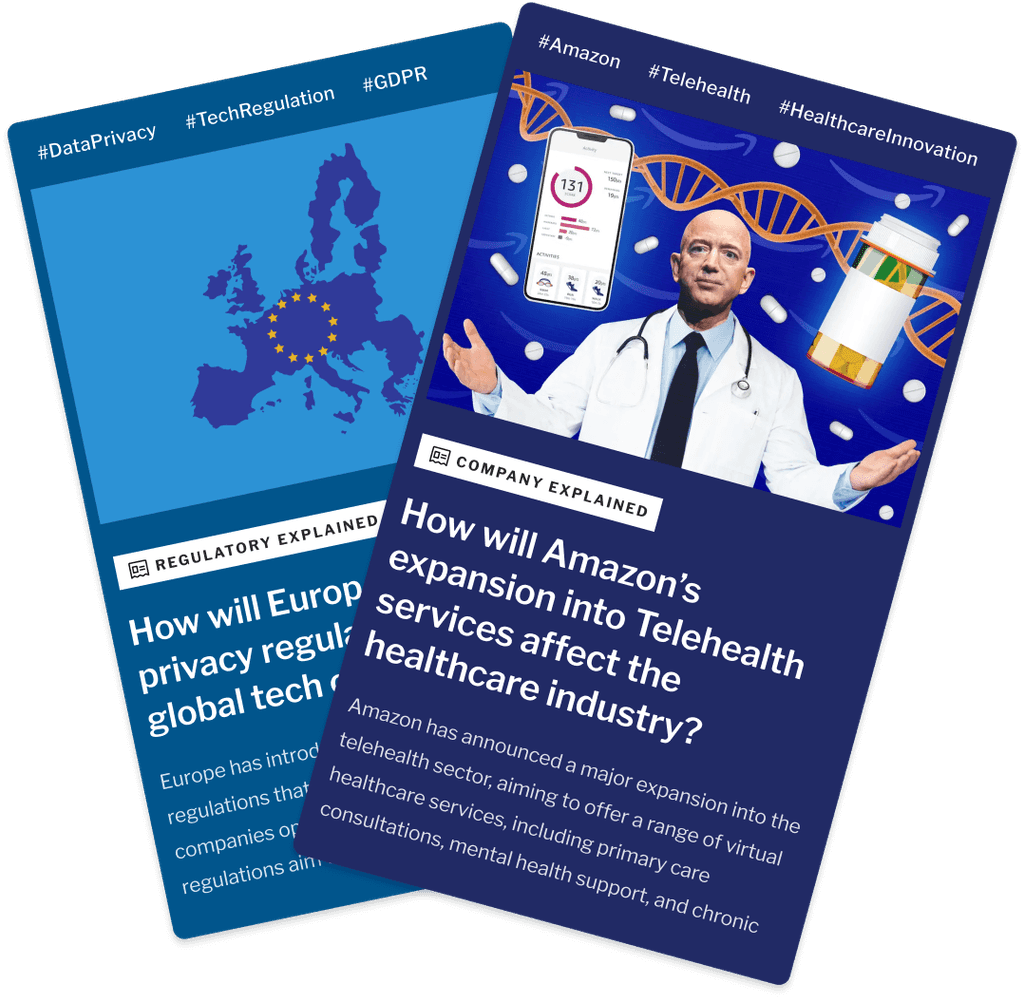

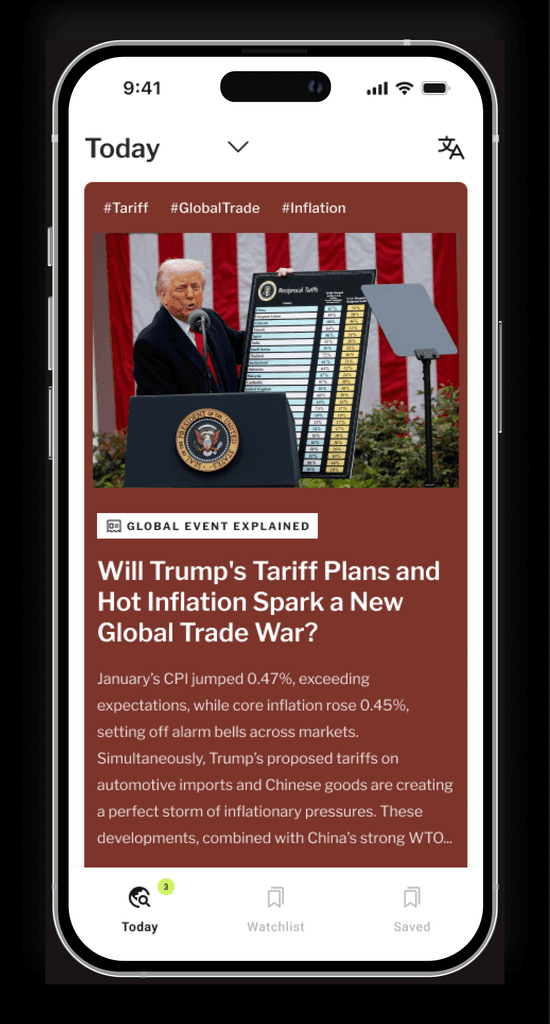

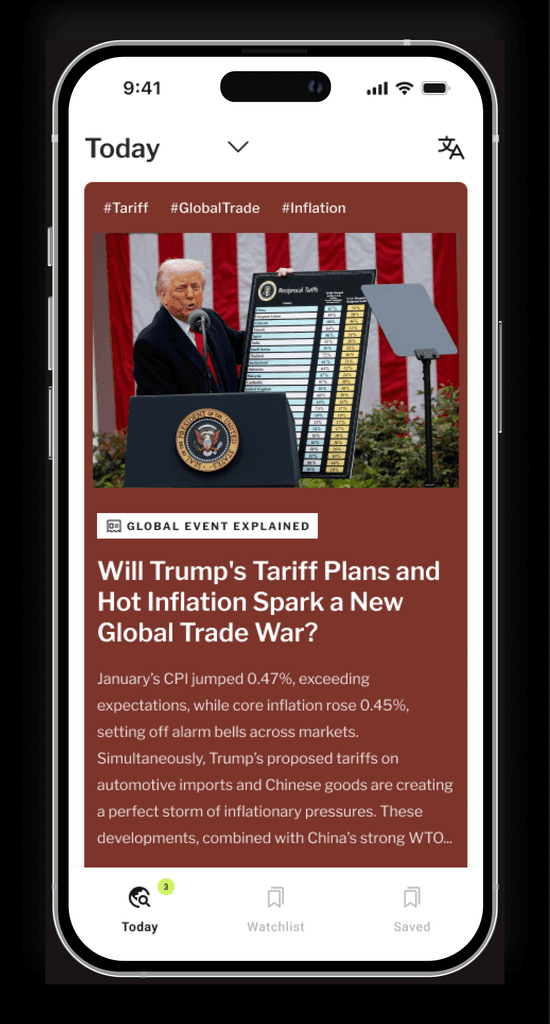

The secret to investment clarity? ask Better Questions.

Every insight card frames the exact question you should be asking

Ask right questions - each card begins with "what," "why," or "how," turning market noise into clear, actionable insights.

Ask right questions - each card begins with "what," "why," or "how," turning market noise into clear, actionable insights.

Think like Wall Street - top investors frame smart questions first - we've already done this work for you.

Think like Wall Street - top investors frame smart questions first - we've already done this work for you.

Spot hidden opportunities - our question approach reveals connections between events others miss.

Spot hidden opportunities - our question approach reveals connections between events others miss.

Insight Cards: 8 ways we help you invest smarter

Insight Cards:

8 ways we help you invest smarter

Macroeconomics

"The Fed raised rates" isn't enough. We decode how major economic shifts impact specific sectors and investment opportunities, revealing connections traditional headlines miss. Our macroeconomic insights help you anticipate market moves before they happen.

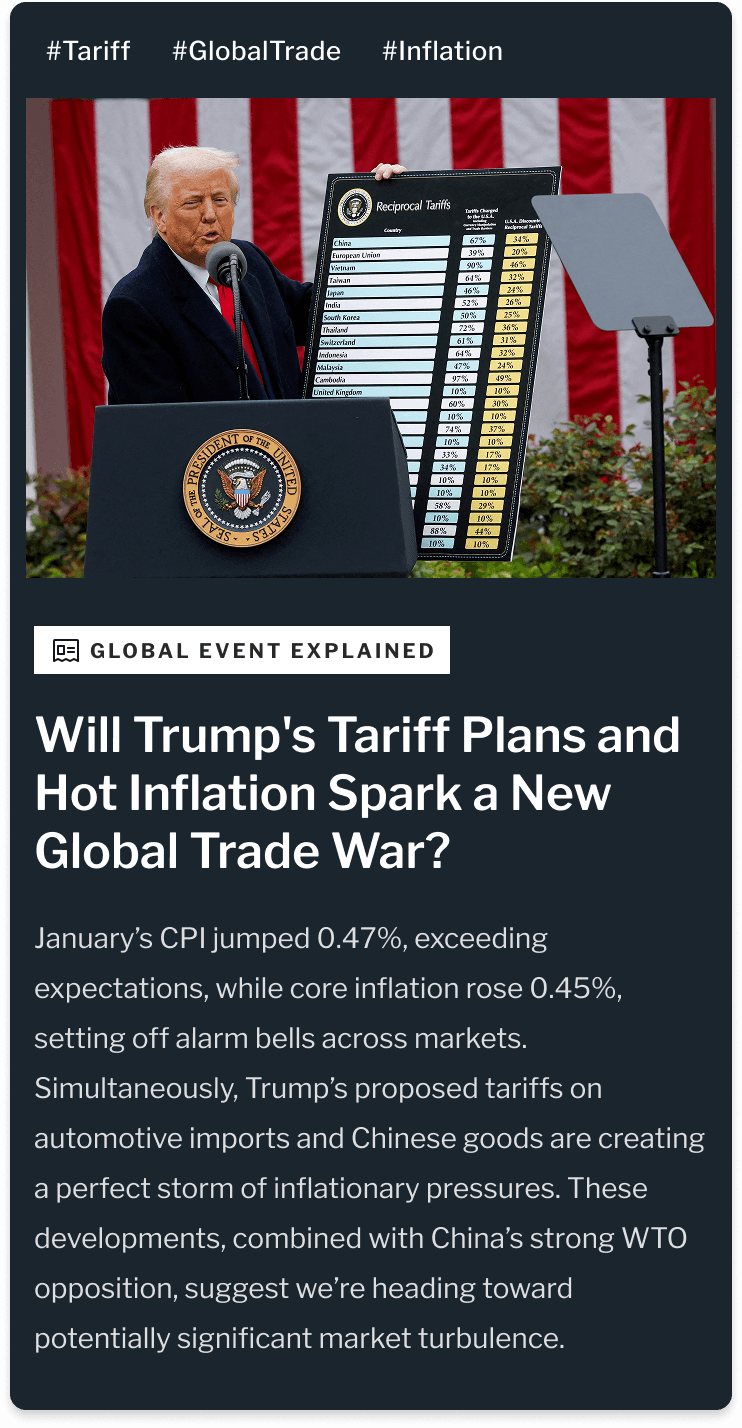

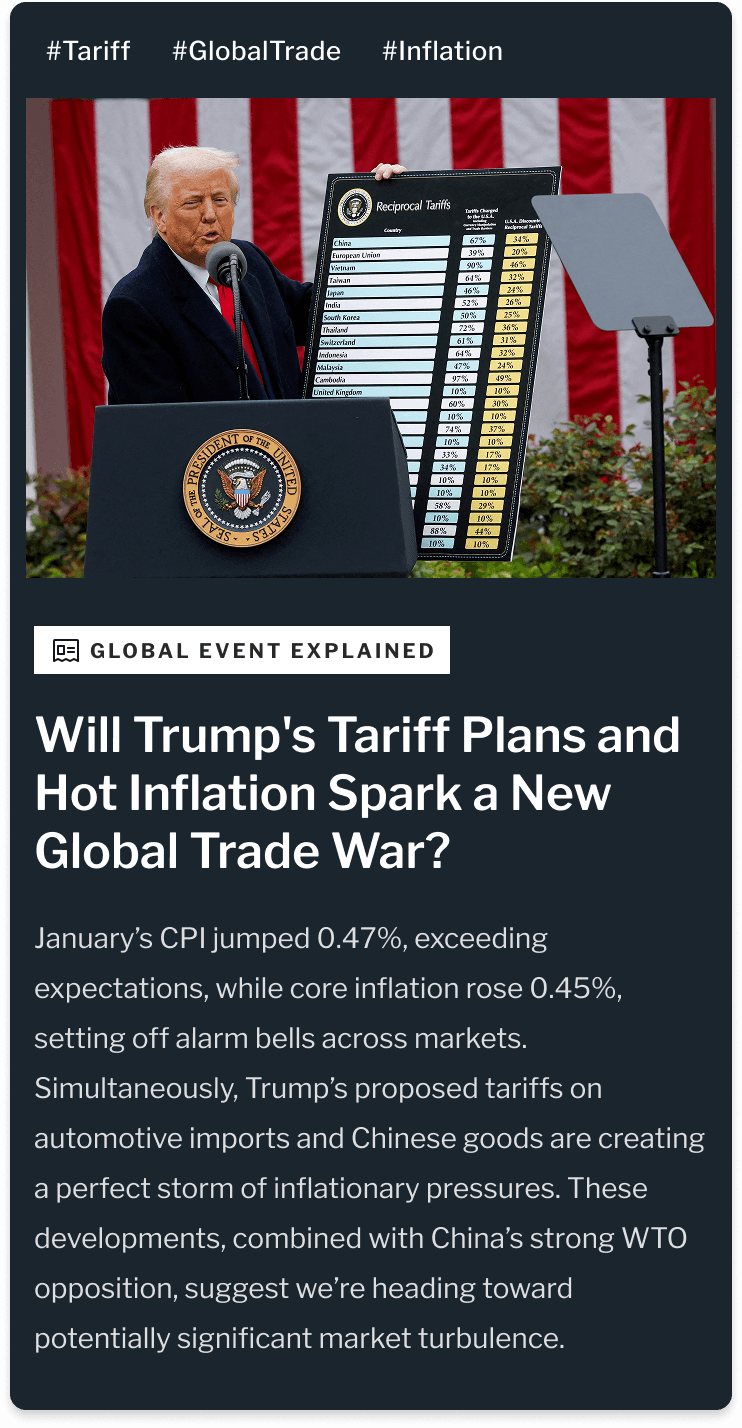

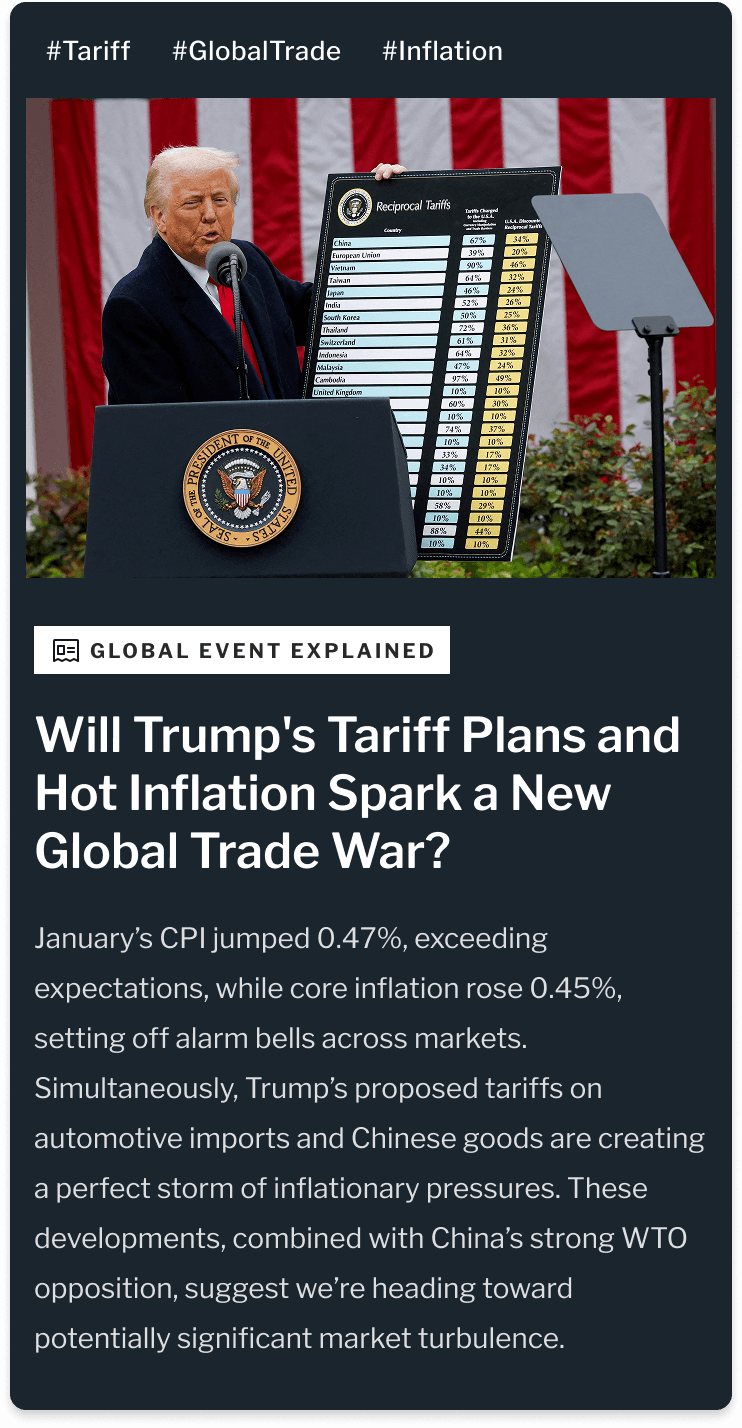

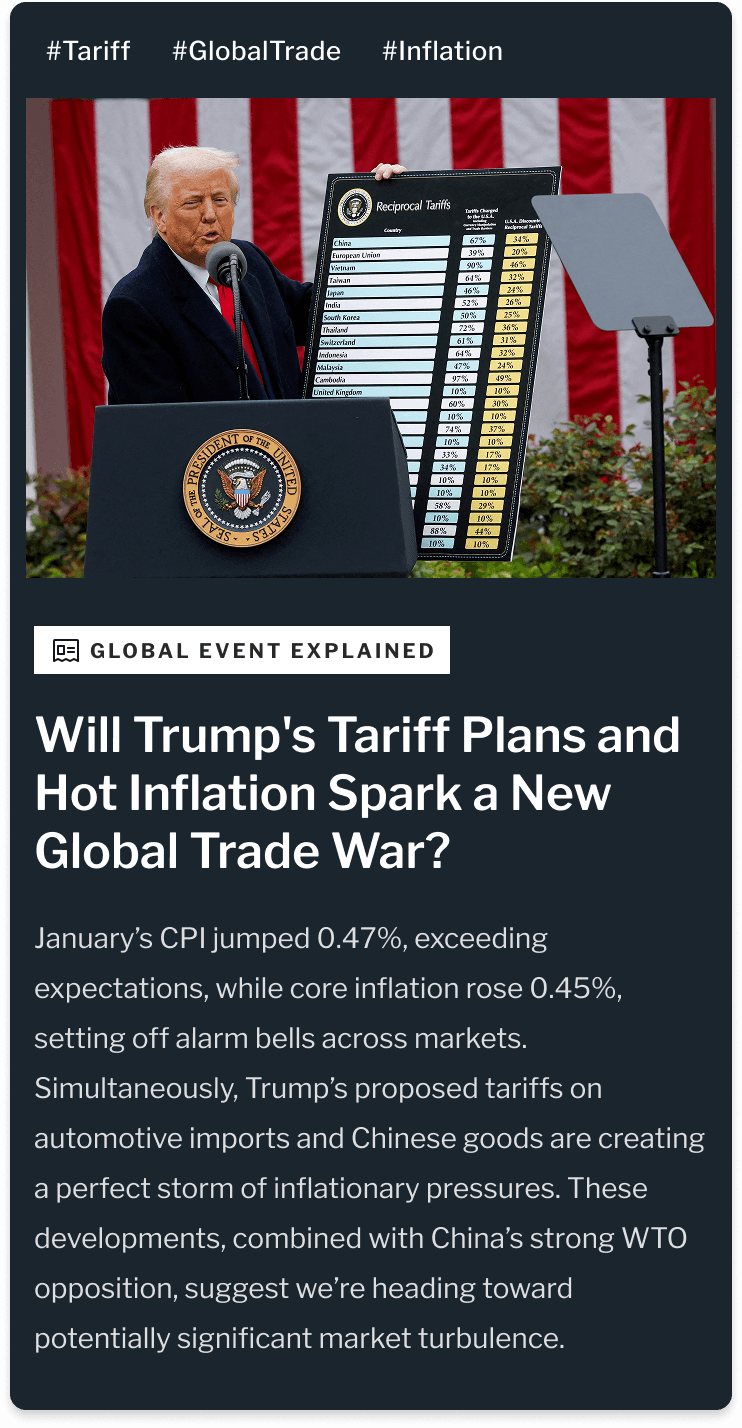

Major event analysis

Breaking news becomes investment clarity. We analyze significant corporate events, product launches, and market shifts to show you exactly how they reshape competitive landscapes and reveal hidden winners and losers that others miss.

Geopolitics

Global tensions create market movements. We translate complex international developments into clear investment implications, showing which sectors and regions face risks or stand to benefit from political and trade developments.

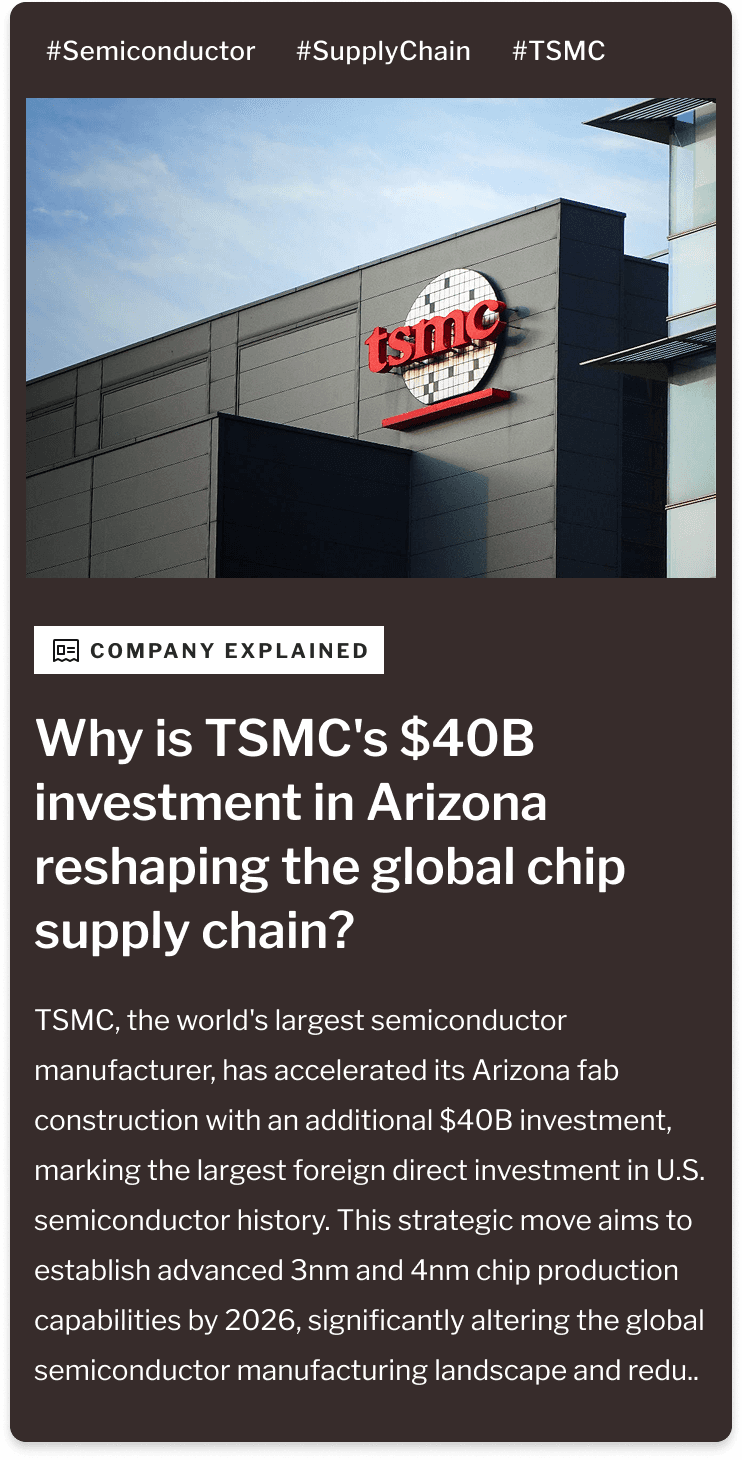

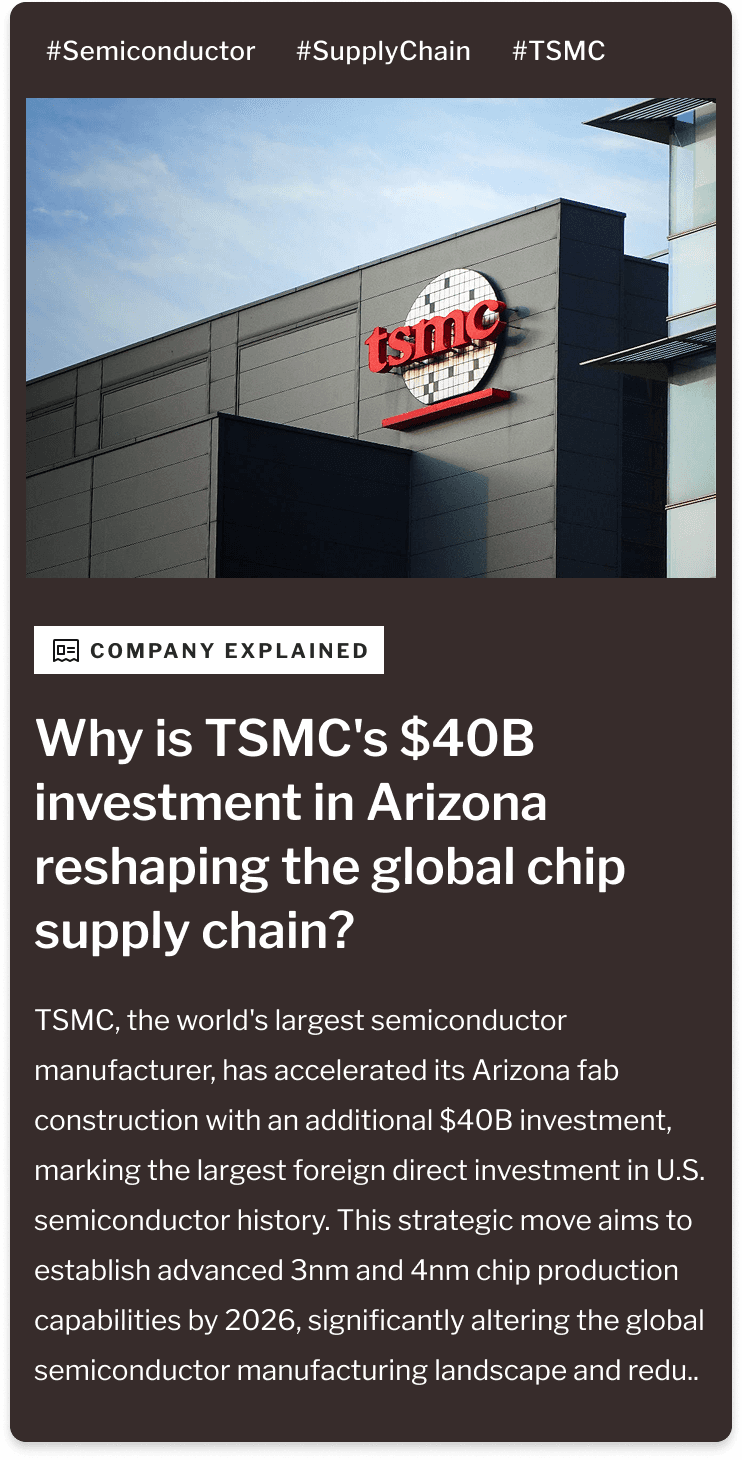

Company & Industry insights

See beyond the headlines to real value drivers. We dissect both individual companies and broader industry trends, spotlighting transformations, competitive shifts, and hidden strengths or weaknesses that typical financial reporting overlooks.

Emerging trends

Spot tomorrow's winners today. We identify early-stage technological, social, and economic trends with significant investment potential, giving you the foresight to position your portfolio ahead of mainstream recognition.

Regulatory impact

Policy shifts create investment opportunities. We break down how new regulations and compliance requirements alter competitive dynamics, creating both challenges for incumbents and opportunities for innovative companies across different sectors.

Underdog spotlights

Hidden gems often outperform market favorites. We highlight overlooked companies with promising innovations, improving fundamentals, or strategic advantages that aren't yet reflected in their valuations—giving you early access to potential breakout performers.

Commodities & Resources

Resource dynamics drive market movements. Our insights connect supply-demand shifts in energy, agriculture, and materials to their broader market implications and specific investment opportunities, helping you navigate volatile commodity markets with confidence.

Macroeconomics

"The Fed raised rates" isn't enough. We decode how major economic shifts impact specific sectors and investment opportunities, revealing connections traditional headlines miss. Our macroeconomic insights help you anticipate market moves before they happen.

Major event analysis

Breaking news becomes investment clarity. We analyze significant corporate events, product launches, and market shifts to show you exactly how they reshape competitive landscapes and reveal hidden winners and losers that others miss.

Geopolitics

Global tensions create market movements. We translate complex international developments into clear investment implications, showing which sectors and regions face risks or stand to benefit from political and trade developments.

Company & Industry insights

See beyond the headlines to real value drivers. We dissect both individual companies and broader industry trends, spotlighting transformations, competitive shifts, and hidden strengths or weaknesses that typical financial reporting overlooks.

Emerging trends

Spot tomorrow's winners today. We identify early-stage technological, social, and economic trends with significant investment potential, giving you the foresight to position your portfolio ahead of mainstream recognition.

Regulatory impact

Policy shifts create investment opportunities. We break down how new regulations and compliance requirements alter competitive dynamics, creating both challenges for incumbents and opportunities for innovative companies across different sectors.

Underdog spotlights

Hidden gems often outperform market favorites. We highlight overlooked companies with promising innovations, improving fundamentals, or strategic advantages that aren't yet reflected in their valuations—giving you early access to potential breakout performers.

Commodities & Resources

Resource dynamics drive market movements. Our insights connect supply-demand shifts in energy, agriculture, and materials to their broader market implications and specific investment opportunities, helping you navigate volatile commodity markets with confidence.

Macroeconomics

"The Fed raised rates" isn't enough. We decode how major economic shifts impact specific sectors and investment opportunities, revealing connections traditional headlines miss. Our macroeconomic insights help you anticipate market moves before they happen.

Major event analysis

Breaking news becomes investment clarity. We analyze significant corporate events, product launches, and market shifts to show you exactly how they reshape competitive landscapes and reveal hidden winners and losers that others miss.

Geopolitics

Global tensions create market movements. We translate complex international developments into clear investment implications, showing which sectors and regions face risks or stand to benefit from political and trade developments.

Company & Industry insights

See beyond the headlines to real value drivers. We dissect both individual companies and broader industry trends, spotlighting transformations, competitive shifts, and hidden strengths or weaknesses that typical financial reporting overlooks.

Emerging trends

Spot tomorrow's winners today. We identify early-stage technological, social, and economic trends with significant investment potential, giving you the foresight to position your portfolio ahead of mainstream recognition.

Regulatory impact

Policy shifts create investment opportunities. We break down how new regulations and compliance requirements alter competitive dynamics, creating both challenges for incumbents and opportunities for innovative companies across different sectors.

Underdog spotlights

Hidden gems often outperform market favorites. We highlight overlooked companies with promising innovations, improving fundamentals, or strategic advantages that aren't yet reflected in their valuations—giving you early access to potential breakout performers.

Commodities & Resources

Resource dynamics drive market movements. Our insights connect supply-demand shifts in energy, agriculture, and materials to their broader market implications and specific investment opportunities, helping you navigate volatile commodity markets with confidence.

Macroeconomics

"The Fed raised rates" isn't enough. We decode how major economic shifts impact specific sectors and investment opportunities, revealing connections traditional headlines miss. Our macroeconomic insights help you anticipate market moves before they happen.

Major event analysis

Breaking news becomes investment clarity. We analyze significant corporate events, product launches, and market shifts to show you exactly how they reshape competitive landscapes and reveal hidden winners and losers that others miss.

Geopolitics

Global tensions create market movements. We translate complex international developments into clear investment implications, showing which sectors and regions face risks or stand to benefit from political and trade developments.

Company & Industry insights

See beyond the headlines to real value drivers. We dissect both individual companies and broader industry trends, spotlighting transformations, competitive shifts, and hidden strengths or weaknesses that typical financial reporting overlooks.

Emerging trends

Spot tomorrow's winners today. We identify early-stage technological, social, and economic trends with significant investment potential, giving you the foresight to position your portfolio ahead of mainstream recognition.

Regulatory impact

Policy shifts create investment opportunities. We break down how new regulations and compliance requirements alter competitive dynamics, creating both challenges for incumbents and opportunities for innovative companies across different sectors.

Underdog spotlights

Hidden gems often outperform market favorites. We highlight overlooked companies with promising innovations, improving fundamentals, or strategic advantages that aren't yet reflected in their valuations—giving you early access to potential breakout performers.

Commodities & Resources

Resource dynamics drive market movements. Our insights connect supply-demand shifts in energy, agriculture, and materials to their broader market implications and specific investment opportunities, helping you navigate volatile commodity markets with confidence.

Features

Features

Features

Your complete market intelligence platform

Your complete market intelligence platform

Decode markets, spot trends, and make informed decisions faster than ever before.

Decode markets, spot trends, and make informed decisions faster than ever before.

Daily Insight cards

Clear, question-based headline with bullet-point explanations of market events that matter.

Portfolio impact analysis

Understand how market developments affect your specific holdings.

Connection mapping

Visualize Complex Market Connections. See the big picture with interactive graphs, uncovering hidden relationships in the financial world.

"Why it's relevant to you"

See exactly how news affects your investment with personalized explanations.

Multi-language support

Multi-language support

Access market intelligence in your preferred language.

Trend Spotting

Trend Spotting

Trend Spotting

Catch Trends Before They Peak. Identify emerging patterns and opportunities before they hit the mainstream.

Instant research tools

Instant research tools

Get comprehensive analysis on any company, industry, or topic in second

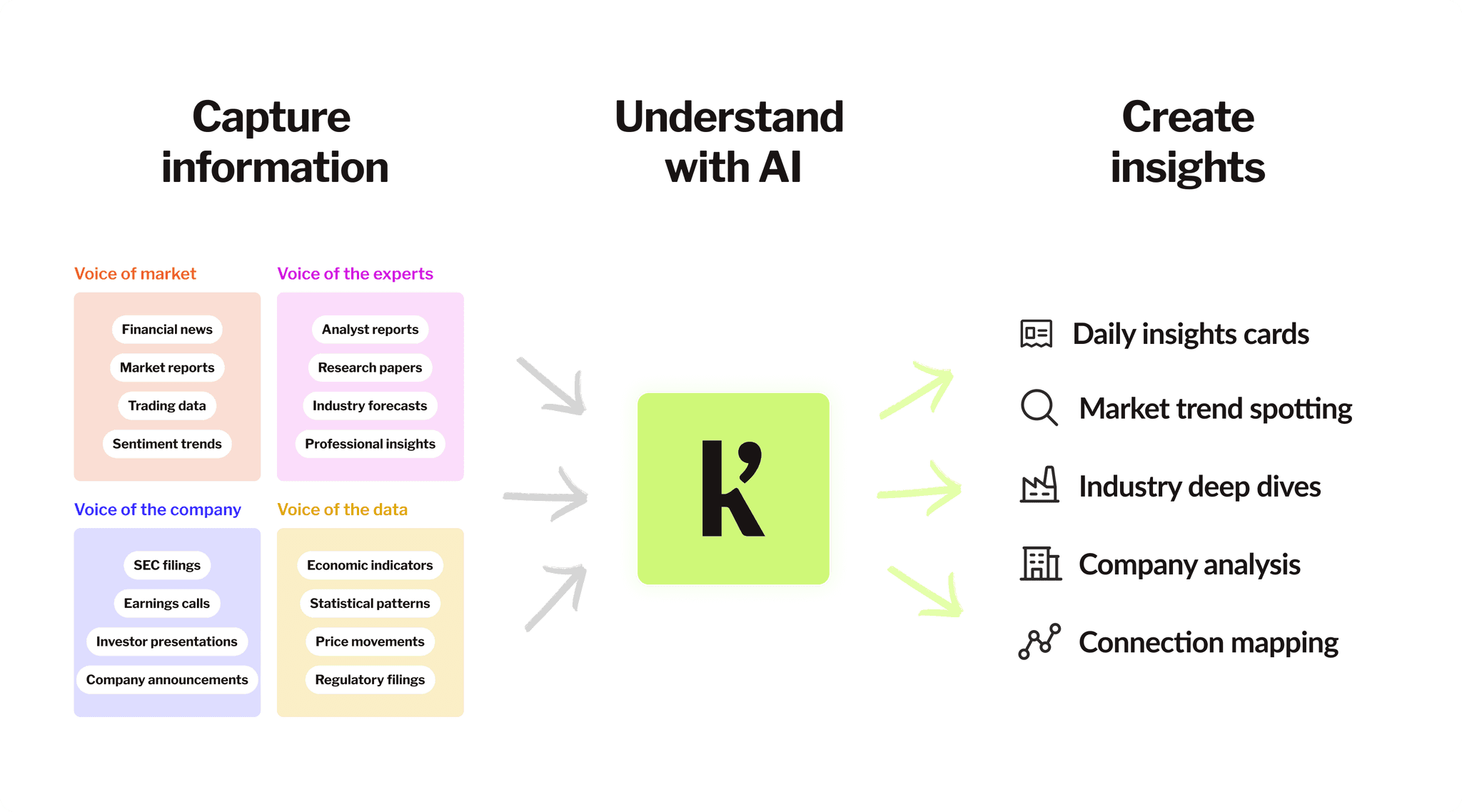

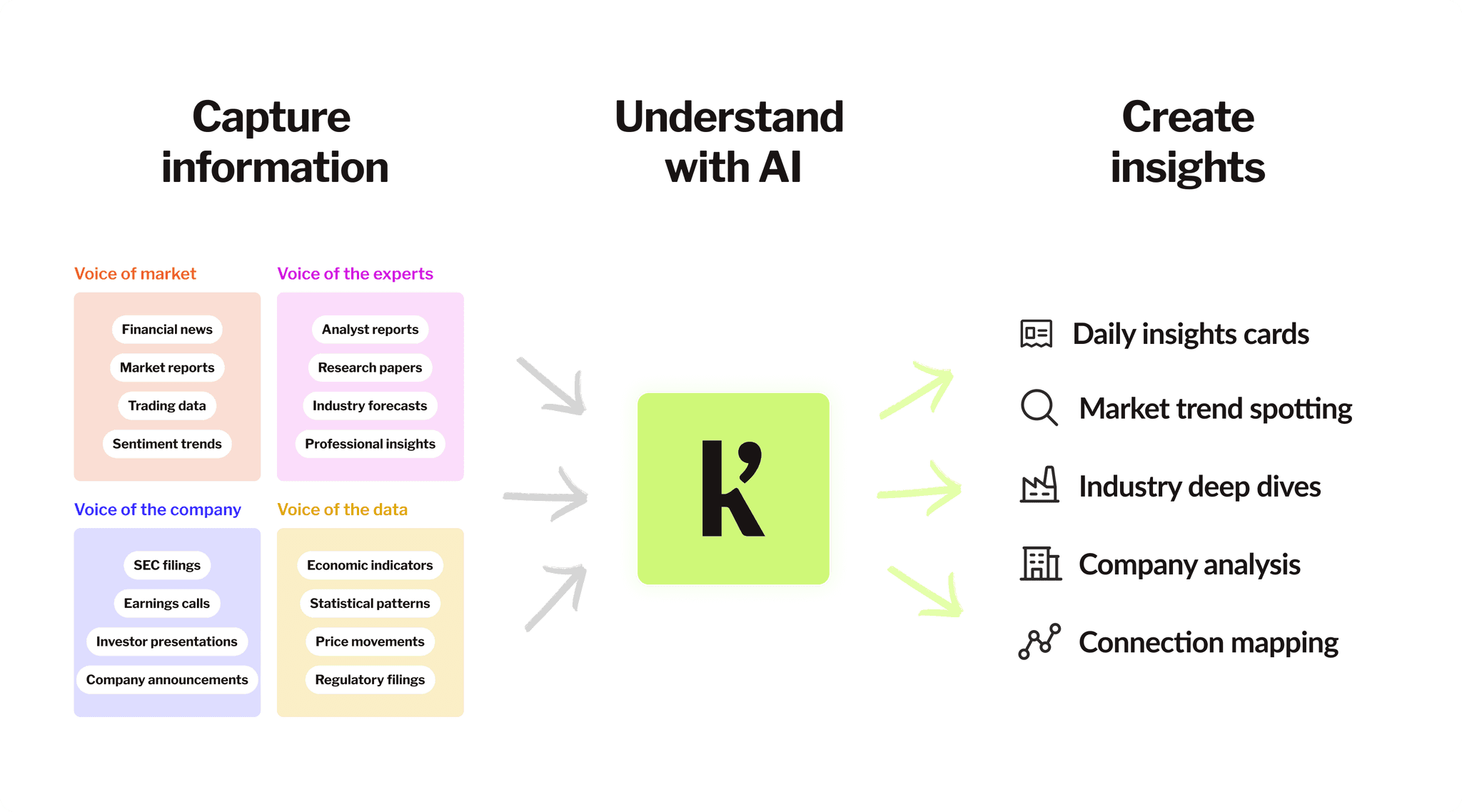

How it works?

How it works?

How it works?

Let knowhy do all the heavy lifting

Let knowhy do all the heavy lifting

How we transform millions of data points into actionable intelligence

How we transform millions of data points into actionable intelligence

Using knowhy

Using knowhy

Using knowhy

Your AI investment analyst, working 24/7

Your AI investment analyst, working 24/7

Unlike ChatGPT, knowhy delivers insights automatically.

No prompting, no research needed!

Unlike ChatGPT, knowhy delivers insights automatically.

No prompting, no research needed!

It’s not another AI research tool

It’s not another AI research tool

Unlike ChatGPT or Perplexity, knowhy doesn't just answer questions - it tells you what questions you should be asking.

What you get

Research approach

Research approach

Personalized to your portfolio

Personalized to your portfolio

Insight quality

Insight quality

Action orientation

Action orientation

User effort required

User effort required

knowhy

Proactive

Proactive

Minimal

(just review what's delivered)

Minimal

(just review what's delivered)

General AI tools

(ChatGPT, etc)

Reactive

Reactive

Varies

Varies

Limited

Limited

Very high

(need to craft effective prompts)

Very high

(need to craft effective prompts)

Financial news site

(Yahoo, etc)

Passive

Passive

Generic

Generic

High

(browsing & filtering needed)

High

(browsing & filtering needed)

Now...

Now...

Investment challenges? Overcome.

Investment challenges? Overcome.

Investment challenges?Overcome.

No more FOMO on market moves

No more drowning in financial news

Spot trends before they're trending

Invest like a Wall Street pro

Love from our users

FAQ

FAQ

FAQ

Common questions

Common questions

Common questions

Everything you need to know about knowhy

Is knowhy really free?

Yep! Our Daily Snack is 100% free. It's our way of giving you a taste of Knowhy's power. The full app will have both free and premium features when it launches.

Is knowhy really free?

Yep! Our Daily Snack is 100% free. It's our way of giving you a taste of Knowhy's power. The full app will have both free and premium features when it launches.

Is knowhy really free?

Yep! Our Daily Snack is 100% free. It's our way of giving you a taste of Knowhy's power. The full app will have both free and premium features when it launches.

Do I need to be a finance expert to use knowhy?

Do I need to be a finance expert to use knowhy?

Do I need to be a finance expert to use knowhy?

How accurate are knowhy's insights?

How accurate are knowhy's insights?

How accurate are knowhy's insights?

Can knowhy replace my financial advisor?

Can knowhy replace my financial advisor?

Can knowhy replace my financial advisor?

How often will I receive insights?

How often will I receive insights?

How often will I receive insights?

What makes knowhy different from other financial news apps?

What makes knowhy different from other financial news apps?

What makes knowhy different from other financial news apps?

When will the full knowhy app be available?

When will the full knowhy app be available?

When will the full knowhy app be available?

How can I join the waitlist for the knowhy app?

How can I join the waitlist for the knowhy app?

How can I join the waitlist for the knowhy app?